Several groups publish real estate sales data.

On a national level, the Standard & Poor's/Case-Shiller Index reports on residential sales in 20 cities across the country. They report that, through the end of September, prices rose 5.6 percent in August, down from the same period last year, which showed a double-digit price increase trend. This slowdown has been attributed to several factors, but primarily to a return to a slow and steady growth pattern in the economy and therefore in housing as well.

On a more local level, the Massachusetts Association of Realtors and The Warren Group, report that sales in Massachusetts have dropped a bit in September from levels seen in September 2013, while median home prices have stabilized. The two agencies differ in their actual numbers/percentages, but both report this slowdown in sales and leveling off of the median home prices in Massachusetts.

On Martha's Vineyard, sales for the period January - September 2014 total 260 for single family homes, with a median price point of $585,500 and an average of 225 days on the market. The same period in 2013 had sales of single family homes totaling 263 with a median price point of $600,000 and 289 days on the market.

Our market seems to be following the state and national trends.

Another factor that we have often seen influencing sales is the election cycle. With several major state and senatorial seats in contest, many potential buyers and sellers adopt a "wait and see" attitude when it comes to their real estate interests.

Other factors that can impact sales include the international turmoil and accompanying threats to the USA and the spread of the Ebola virus.

Interest rates remain stable and there are some qualification and oversight changes in the works for lending institutions that will take effect in 2015, so we can expect some improvements in the lending field for buyers. That, and the elections and incoming representatives (whoever they may be), should spur new activity in the New Year.

Plan now to make your real estate ownership dreams a reality. Call a professional.

Wednesday, October 29, 2014

Friday, September 5, 2014

7 Tips for Home Sellers Regarding Energy!

From "Ready. Set. Sell. How Energy Efficiency Can Help Sell Your Home"

- Get a home energy evaluation to spot ways to make your house cooler in summer and warmer in winter. It will give you a plan for energy efficiency, an attractive selling point.

- Swap in high-efficiency, compact fluorescent (CFL) light bulbs that will cut your utility bills immediately.

- Improve insulation which can trim up to 20% off heating and cooling bills, according to Energy Star.

- Install low-flow faucets and shower heads and save between 25% - 60% on water.

- Use programmable thermostats to help cut heating and cooling costs by 5% - 15%. Check out Nest thermostats.

- Consider investing in solar power to save up to 25% on electric bills and add $20,000 to the value of a home for each $1,000 in annual energy savings. Massachusetts currently offers some tax incentives to install solar panels.

- Document your improvements and energy savings so real estate agents can give that info to buyers.

Check out the website NextStepLiving.com for more information.

This article was in the Bay State Realtor magazine, a benefit of being a Realtor. Hire a professional.

Thursday, August 14, 2014

Wednesday, July 16, 2014

Buying A Vacation Home? Here Are 6 Important Considerations

Whether your purchase is for personal or investment use, here are some key criteria to consider when assessing your choices.

1. Keep costs within your budget. Get pre-qualified for a loan before looking for that dream vacation home - unless you are paying cash. Consider these ongoing costs that come with a second home and how much ongoing income you will need to meet these obligations. These are costs incurred whether you rent the home or not.

1. Keep costs within your budget. Get pre-qualified for a loan before looking for that dream vacation home - unless you are paying cash. Consider these ongoing costs that come with a second home and how much ongoing income you will need to meet these obligations. These are costs incurred whether you rent the home or not.

- Monthly mortgage

- Real Estate Taxes.

- Municipal assessments

- Maintenance

- Homeowners insurance

- Flood insurance (see my earlier article on this!)

- Furnishings

- Caretaker

- Emergency fund

- Travel costs for you to visit the property

2. How often are you going to use it? Is it a 2 hour drive, a one hour ferry ride or a combination that will make it difficult to arrange for that amount of time. Are family and friends a consideration in deciding on a location? If so, where are they coming from? Is the house suitable for use in the "shoulder" seasons?

3. Let's talk location. If the beach is important to you - the house you select should be close enough that you can get their. Additionally, if that is the paramount reason that someone would want to rent your property, make sure it fills that bill. Beach is not the only consideration. Think about transportation to and from the house, to town, to other recreational activities. Don't buy a house out in the woods, far from everything, unless you are using it to write the next great American novel and need the solitude!

4. Maintenance. The lawn will still need to be mowed even if you are not here. And, do you want to spend your vacation time mowing grass? Painting trim? Winterization? Some areas have homeowner associations who will let you know if you are not keeping your property up to par, but you can't depend on that - you'll want/need a caretaker. Many areas of vacation homes have a proliferation of property managers. Get recommendations though, because the last thing you want is the call that water is pouring out of the windows of your vacation home!

5. Income Potential. Find out about the rental market. What is the vacancy rate? What will it cost you to list your property on one of those vacation rental sites? Can you handle the calls and money or should you hire a local professional? If so, what will they charge? A local rental agency can give a realistic price range/date range for the rental of your property and provide some other useful services, such as meeting and greeting your tenants and handing over and collecting keys. All of this effects your bottom line, so don't be too easily swayed by the weekly rental number and remember, you are opening your home to people you don't know. Be prepared.

6. Selling Out or Trading Up. A second/vacation home is not usually a forever home, so gaze into your crystal ball and think about where you want to be in 5 years or 10 or whatever number and gauge how this property will fit into that plan. Will the property hold its value or are the kids hoping you'll pass it along to them. And consider the tax consequences. There could be capital gains taxes, depreciation recapture, etc. You need to factor this into the decision to buy that second home.

Your real estate professional is here to assist you in making this important decision and in answering these important considerations. A summer home can be yours - happily!

Sunday, June 22, 2014

Disclose Encroachment

Disclose Encroachment

How does a listing agent know when to disclose property line problems?

MAY 2014 | BY BRUCE AYDT

Q: A neighbor’s fence cuts into the seller’s lot. As the listing agent, should I disclose that?

A: Article 2 of the Code of Ethics requires REALTORS® to avoid “exaggeration, misrepresentation, or concealment of pertinent facts relating to the property or the transaction. REALTORS® shall not, however, be obligated to discover latent defects in the property.”

The Code of Ethics and Arbitration Manual discusses “pertinent” facts: “Absent a legal prohibition, any material fact that could affect a reasonable purchaser’s decision to purchase, or the price that a purchaser might pay, should be disclosed . . . if known by the REALTOR®.”

Included in the concept of pertinent facts is a fact that may affect “the potential purchaser’s ability to resell the property at a future date.” The encroachment of the neighbor’s fence onto the property of the listing clearly may affect what a reasonable buyer may decide to purchase in that the title to the property has some “flaw” or “cloud.” The encroachment may also affect the buyer’s ability to sell the property in the future unless the encroachment is resolved.

Unless the seller can work with the neighbor to resolve the problem, that encroachment is likely a pertinent fact that should be disclosed to a prospective buyer. Most likely this sort of encroachment would also be required to be disclosed on a seller’s disclosure statement, whether the disclosure statement is required by law or by practice. Even if the encroachment is considered “minor,” it may still be considered pertinent by a hearing panel in an ethics complaint. As in any question of disclosure, the best practice to stay within the Code is “when in doubt, disclose.”

I've had this question raised many times, regarding several different topics, and it always comes back to the question "If it would impact a buyer's decision to purchase the property, it should be disclosed." And the Golden Rule with a twist - wouldn't you want to know if you were the buyer?Saturday, May 10, 2014

Your Secret Credit Score

So, you’ve been diligent; paying your bills on time;

checking your Free Credit Score periodically. Everything looks great and you’re ready to buy a house. You’re confident and you make an offer

on the home of your dreams. You

meet with your mortgage broker and fill out all the paperwork to apply for that

mortgage, confident that your good credit score is going to put you in that

house at a great rate.

Surprise!

Your mortgage broker sends you a commitment letter with

terms you don’t understand. How

could they be asking you for more information, and offering you a higher rate

than you expected?

You have a secret credit score.

That free credit report you get so easily is not the credit

report that your mortgage lender will see. And now you have only a short period of time to “fix it”, if

you can!

How to avoid this?

Get your mortgage broker (or friendly banker, if you’re early in the

purchase process) to run your credit and review it with you. You’ll see things there that you may

have time to dispute and correct. The

credit bureaus have a process for disputing charges and things like duplicate

accounts, mixed identities, etc., but you’re going to have to direct that

process. There was a recent news

article about this process and the lax attention and zero responsibility that

the credit bureaus have for correcting bad information on you.

Also, if your credit report is “pulled” too many times, it

lowers your score!

Unfair - yes!

So, be proactive and protective of your credit health. Review your real credit

score/report and get on with making your real estate dreams a reality!

Friday, May 9, 2014

Lead Paint Horror Stories

I just heard a horror story about lead paint where the seller was a municipality and the buyer had a 4 year old son. The municipality assured the buyer that there was no lead paint in the 1890 structure. Two years later, the son tested positive for lead paint levels above normal!

The following answers some common questions about lead paint.

It’s Always A Good Time To Review

the Massachusetts Lead Paint Law Disclosure Requirements

By Rich Vetstein on May 08, 2014

05:00 pm

Fraught with liability and danger,

the Massachusetts Lead Paint Law is always a hot topic for Massachusetts

residential real estate professionals. Fortunately for us, my colleague Attorney Marc Canner recently

gave a seminar on the Lead Paint Law in which he prepared a very helpful

Frequently Asked Questions (FAQ) with Practice Pointers which he’s graciously

allowed me to share here.

The overriding policy of the Mass.

Lead Paint Law is to encourage full disclosure of all lead paint related issues

and give buyers the opportunity to test for lead paint before they purchase a

home with lead paint. Unlike rental properties, however, there is no obligation

on the seller to de-lead prior to a private sale. But common sense dictates

that a lead-free house may be more valuable and marketable,

and this is particularly true for multi-family properties where tenants with

children under six years of age may in any event trigger the

de-leading requirements of the law.

Further, penalties for

non-compliance with the disclosure requirements are quite stiff. Sellers and

real estate agents that do not meet the requirements can face a civil penalty

of up to $1,000 under state law and a civil penalty of up to $10,000 and

possible criminal sanctions under federal law for each violation. In addition,

a real estate agent who does not meet requirements may be liable under the

Massachusetts Consumer Protection Act, which provides up to triple damages.

What lead paint disclosures does a

listing agent have to provide?

Whenever an owner of a home built

before 1978 sells, the listing agent must provide the (1) the “Property

Transfer Notification Certification”, and (2) all 10 pages of the Department

of Public Health’s “Childhood Lead Poisoning Prevention Program ‘CLPPP’

Property Transfer Lead Paint Notification.” Most agents only use the

one page form, and that’s a “no-no.”

Practice tip: It is a good idea to

combine the two forms as one document in DotLoop (or other transactional

software system) or on the MLS when the listing agent is providing these to the

Buyer.

Can the Buyer sign the Property

Transfer Notification Certification form before the Seller?

No. It is invalid. The Property

Transfer Notification Certification (“Property Transfer Form”) must be

completed and signed by the Seller before the Buyer can sign. The Buyer’s

signature acknowledges they are in receipt of the disclosure. Thus, the Buyer

cannot be in receipt of the disclosure until the Seller first completes the

form.

Practice tip: If the listing agent

is slow to send the Property Transfer Form, then the buyer’s agent should document

the requests by email. In addition, the buyer’s agent should email the listing

agent’s broker to request the timely receipt of the Property Transfer Form.

What disclosures and

acknowledgements have to be completed on the Property Transfer Form?

All disclosures and

acknowledgements have to be accurately completed, including the Seller’s

Disclosure, the Purchaser’s or Lessee Purchaser’s Acknowledgement and the

Agent’s Acknowledgement. Agents should be aware that HUD and the EPA have

audited broker’s files in the past and have at times found them deficient from

a compliance standpoint. Thus, it is critical to accurately fill out the form.

Practice tip: Make sure that the

Property Transfer Form includes the property address. The older form, “CLPPP

form 94-3 dated 6/30/94” does not include a line for the address. Both agents

working on the transaction should sign the form.

Does a listing agent have to

provide a Property Transfer Form for a property built after 1978?

No. The lead paint law only applies

to homes built after 1978. Therefore, testing for lead-based paint is not

required.

Practice tip: If the listing agent

provides a Property Transfer Form for a home built after 1978, neither the

buyer nor the buyer’s agent has to sign the form.

Does a Seller have to accept an

offer from a Buyer who is requesting lead paint testing?

A property owner or real estate

agent cannot sidestep the lead paint law simply by refusing to sell or rent to

families with young children. The purpose of the lead paint law it to protect

the health of children and pregnant women. An owner cannot refuse to sell or

refuse to renew the lease of a pregnant woman or a family with young children

just because a property may contain lead hazards that they do not want to spend

the money to remove. Any of these acts is a violation of the Lead Law, the

Consumer Protection Act, and various Massachusetts anti-discrimination statutes

that can have serious penalties for a property owner or real estate agent. A

case in point: a Boston area landlord was recently hit with a $75,000

penalty by the Mass. Attorney General’s office for lead paint

violations.

What is required to obtain a

Certificate of Compliance?

Owners of homes built before 1978

where children under six live should have the property inspected by a licensed

lead inspector. Typically, an inspector will look to remove peeling, chipping

or flaking paint. A full list of surfaces to be deleaded is available in the

CLPPP form.

Practice tip: To contact a licensed

lead inspector, click this link.

Does a listing agent need to

disclose a Letter of Interim Control?

Yes. A Letter of Interim Control is

only valid for one year. Thus, if a home built before 1978 that has a Letter of

Interim control but does not have a Certificate of Compliance, then the agent

needs to Disclose the Interim Letter of Control and likely engage a

professional to determine what work is needed to bring the property into

compliance.

What is the contractors’ role in

the lead removal process on home improvement projects?

In a previous article, I noted that new regulations

went into effect in 2010 that cover paid renovators who work in pre-1978

housing and child-occupied facilities, including renovation contractors,

maintenance workers in multi-family homes, painters and other specialty trades.

These regulations provide that most home improvement projects on homes built

before 1978 require certified lead paint removal project contractors to follow

strict lead paint removal precautions. Nothing in these new rules requires

owners to evaluate existing properties for lead or to have existing lead

removed.

Are there lead paint removal tax

credits and loans available?

There are a number of lead paint

removal no and low cost loans available. MassHousing, for example, has a “Get the Lead Out” Lead Paint Removal loan program

for income eligible owners or tenants.

In addition, Massachusetts has a

tax credit of up to $1,500 for each unit deleaded.

If an agent has a buyer purchasing

a home built before 1978, should the agent request lead removal be done before

the closing or after the closing?

If making these strategic

decisions, we recommend that you consult a real estate attorney in order to be

in full compliance with lead paint laws.

At closing, should Sellers sign the

form in the closing package that says the Seller agrees to remove all known

lead paint?

The form typically contained in

most lender closing packages states that the Buyer agrees to indemnify and hold

the lender harmless in the event of any non-compliance with lead paint laws.

___________________________

Richard Vetstein and Marc Canner

are Massachusetts real estate attorneys. Rich can be reached at

rvetstein@vetsteinlawgroup.com and Marc at mcanner@cannerlaw.com

Thursday, April 17, 2014

Open House at 51 Old Purchase, Edgartown on April 26, 2014

We will be hosting an Open House to the public on Saturday, April 26, 2014 from 11:00 - 2:00. This 3 bedroom, 2 bath home has been carefully maintained and is located in a convenient and popular area. Come by or call 508-939-0206 to arrange a private viewing.

Tuesday, April 8, 2014

Flood Insurance and Its Impact on Property Values

The Biggert-Waters Act that, when implemented, will redraw

the flood plain maps nation-wide and allow insurers to recoup losses suffered

from major storms such as Hurricane Sandy, has been modified. President Obama has signed the HFIA A14

(Homeowner Flood Insurance Affordability Act, Article 14), which puts off some

of the major impactful aspects for 4 years, requires a reexamination of the

flood maps and contains the following highlights:

- The sale of a property is not a trigger.

- Annual premium increases will be limited to a minimum 5% increase and a maximum 18% increase on renewals.

- Establishes a surcharge for existing policies.

- Maintains the Grandfathering rules currently in effect.

- Maintains the 25% premium increases for non-primary, business properties and severe repetitive loss properties.

What does this mean for you if you have a property in a

flood zone? Increased premiums. Maybe not substantially, at first, but

there is one other consideration that will realize a major impact - property

value.

Property value is comprised of a number of aspects - you’ve

heard the term “location, location, location”. But other factors such as condition also impact value. In the past, having a beachfront

property meant a higher price tag and you (the Buyer) expected to have higher

expenses, such as real estate taxes, etc.

Enter the new flood insurance.

If your annual premium, in just the first year, is $50,000 for $250,000

of insurance (the maximum amount you can procure from the government - the rest

must be purchased from private insurers), will this impact your decision to

buy? Will it impact how much you

are willing to pay for this property?

Yes.

If over the course of your ownership the premium cost to you

will increase between 5 - 25% per year, this impacts the value of the house and

what anyone would be willing to pay for it. If its not your primary residence, its 25% increase every

year! And, remember, insurance

policies are based on replacement cost - not what you paid - not what the

assessors think its worth, but what it will cost to replace the structure.

Here on Martha’s Vineyard, the cost per foot for new

construction can vary widely, so your premium will also vary depending on that

factor alone. If you pay cash for

your home, or have no mortgage, you do not have to purchase flood

insurance. Just remember that FEMA

is not going to bail you out (literally) should a major event occur.

Expect to see waterfront/flood zone properties decrease in

value. The municipalities where

these properties stand will see their tax revenues decline as property owners

file for abatements based on their inability to sell or because they purchased

a property at a price far below the assessed value. Almost a tsunami.

Wednesday, February 19, 2014

Home Sales Up in 3 of 4 Regions

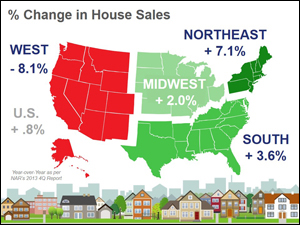

Some industry gurus are questioning whether the housing momentum we saw early in 2013 began to dissipate later in the year. The more dramatic have claimed the housing sector is still on shaky ground. Others have blamed the slowdown in sales on a lack of consumer confidence or rising interest rates. The National Association of Realtors (NAR) just released their 2013 4th Quarter Housing Report. The report revealed that home sales numbers barely outperformed (an .08% increase) those in the 4th quarter of 2012. We believe the leveling in home sales is directly attributable to a lack of salable listing inventory; specifically in the West. Three of the four regions in the NAR report had an increase in sales: Northeast (+7.1%), Midwest (+2%) and South Regions (+3.6%). A big fall-off in sales occurred in the Western Region. The dramatic fall-off in the West (-8.1%) can be directly linked to a shortage of inventory in their hottest markets. If the decrease in sales was caused by an eroding of consumer confidence and/or rising interest rates, we believe each region would have seen similar decreases. Here on the Vineyard we are also experiencing a lack of inventory in most price ranges. This may be relieved as the weather improves (please - let the weather improve!). What homes are for sale are being looked at, even though its February. Perhaps the buying public is tired of waiting - even for their second home, which is our primary market. |

Sunday, January 26, 2014

Proposed Revised Flood Plain Maps for Martha's Vineyard

I've just attended a seminar on new flood maps and how they will impact homeowners' insurance on Martha's Vineyard. The new maps increase the area of potential impact and future real estate sales. If a home is located within one of the zones and the buyer obtains a mortgage to purchase the property, the lending institution will require a certificate of elevation. A licensed land surveyor and several other professionals are licensed to do these at varying costs, depending where GIS sites are located, etc. This will create an added cost to the buyer/seller (not clear who should bear this cost yet). This certificate can delay the closing process by weeks. The insurance premiums will continue to increase over the years - as approved by the government, which guarantees the first $250K in these policies. The government (FEMA) and the insurance companies have depleted their reserves with the Hurricane Katrina and Sandy cleanups/payouts. So, the government has agreed that they can: increase the flood plains and insurance rates.

If there is no mortgage on the property, there is no requirement (as of today) for that homeowner to purchase flood insurance. However, if you currently have flood insurance on your property, expect the rates to increase, perhaps substantially.

The new maps are still a year or so away from being finalized as each municipality has the right to review and revise, plus there is an appeal period. For more information, please contact your insurance company. They will be able to definitively identify how this

may impact you and your home.

Do You Toss Those Bank Statement Inserts?

I usually do, but this time I decided to read it. And I decided that it contained some useful information worth sharing.

First I learned that my bank account/checks are protected by something called EZShield! Didn't know that and there's more.

Did you know? More than 1.2 million fraudulent checks are written each day - more than 13 per second?! (Office of the Comptroller of the Currency). Scary!

So here are some helpful tips on protecting your money and your identity.

1. Monitor your accounts and monthly statements to ensure their accuracy. Surprisingly, many people don't bother to balance their personal checkbooks! I guess I'm weird that way. Plus I look at my credit card statements carefully!

2. Each year, order copies of your credit report from each of the three major credit bureaus to verify their accuracy. This one bit me a few years ago. One of the credit bureaus combined my credit with the credit of someone whose name was similar (her credit wasn't as good). Could have been a catastrophe for me as I was in the middle of buying a house, but I did get it worked out.

3. Thoroughly shred documents containing any personal information before disposing. Think about what is on your bank statement - photocopies of your signature! Never mind the account number, where you spend money, etc.

4. Never write your Personal Identification Number of your ATM/Debit card. And never write your Social Security Number or credit card number on a check. We live in a password-protected society and it's hard to remember all the user names and passwords, but this advice is critical, and I would add that you shouldn't sign up for more credit cards or add PINs to existing cards if you don't need them!

5. Remove passwords, PINs and identification cards containing your Social Security Number from your purse or wallet. I'm removing mine today! Yikes!

6. Never put outgoing mail that may contain checks or tax documents in your mailbox at home. They know where you live!

7. At home, keep a checklist of the critical items stored in your wallet, purse, laptop and/or PDA. I can tell you that I was scared breathless when I left my laptop at the airport! (I was one of the lucky ones and did get it back - intact).

8. Only order from internet sites that use secure methods of obtaining personal account or credit card information. Duh!

9. Always log off after an online banking session. No need to elaborate on this tip!

If you suspect your identity has been stolen/compromised:

1. Immediately file a report with your local police.

2. Call the Federal Trade Commission at 1-877-ID-THEFT.

3. Contact the three major credit bureaus to place a fraud alert on your record.

4. Maintain a record of each contact with authorities.

So, that's most of what was on that little piece of paper that was in with my bank statement. My thanks!

First I learned that my bank account/checks are protected by something called EZShield! Didn't know that and there's more.

Did you know? More than 1.2 million fraudulent checks are written each day - more than 13 per second?! (Office of the Comptroller of the Currency). Scary!

So here are some helpful tips on protecting your money and your identity.

1. Monitor your accounts and monthly statements to ensure their accuracy. Surprisingly, many people don't bother to balance their personal checkbooks! I guess I'm weird that way. Plus I look at my credit card statements carefully!

2. Each year, order copies of your credit report from each of the three major credit bureaus to verify their accuracy. This one bit me a few years ago. One of the credit bureaus combined my credit with the credit of someone whose name was similar (her credit wasn't as good). Could have been a catastrophe for me as I was in the middle of buying a house, but I did get it worked out.

3. Thoroughly shred documents containing any personal information before disposing. Think about what is on your bank statement - photocopies of your signature! Never mind the account number, where you spend money, etc.

4. Never write your Personal Identification Number of your ATM/Debit card. And never write your Social Security Number or credit card number on a check. We live in a password-protected society and it's hard to remember all the user names and passwords, but this advice is critical, and I would add that you shouldn't sign up for more credit cards or add PINs to existing cards if you don't need them!

5. Remove passwords, PINs and identification cards containing your Social Security Number from your purse or wallet. I'm removing mine today! Yikes!

6. Never put outgoing mail that may contain checks or tax documents in your mailbox at home. They know where you live!

7. At home, keep a checklist of the critical items stored in your wallet, purse, laptop and/or PDA. I can tell you that I was scared breathless when I left my laptop at the airport! (I was one of the lucky ones and did get it back - intact).

8. Only order from internet sites that use secure methods of obtaining personal account or credit card information. Duh!

9. Always log off after an online banking session. No need to elaborate on this tip!

If you suspect your identity has been stolen/compromised:

1. Immediately file a report with your local police.

2. Call the Federal Trade Commission at 1-877-ID-THEFT.

3. Contact the three major credit bureaus to place a fraud alert on your record.

4. Maintain a record of each contact with authorities.

So, that's most of what was on that little piece of paper that was in with my bank statement. My thanks!

Friday, January 24, 2014

Your Home Maintenance Checklist!

-

Is Your Home Older Than Its Years?

Would you throw away $20,000? You are if you’re letting your home age faster than it should. Here’s a simple maintenance strategy to keep your home young. Read

Visit houselogic.com for more articles like this.

Copyright 2014 NATIONAL ASSOCIATION OF REALTORS®

Thursday, January 9, 2014

Susan

Cahoon, Principal and Broker of Homes on Martha’s Vineyard, was recently

awarded the National Association of Realtors’ SRES designation. SRES, which stands for Seniors Real

Estate Specialist, is earned when a Realtor completes a training course and

passes an examination. SRES professionals

are well-versed in the needs of our growing and aging population, from the “GI

Generation” to the “Millennials”.

“Senior” now encompasses anyone over the age of 50! “Our needs are often complex, and must

address a range of services, while still considering the must-haves of younger

family members”, said Susan. “That’s why getting this additional training and

knowledge was so important to me.”

An SRES Realtor has access through a wide network of professionals who

provide specialized from reverse mortgages to identifying appropriate adult or

assisted-living communities.

Susan

has been a real estate professional since 1975, working in management, sales,

property management and development in both residential and commercial real

estate in the Suburban Boston and Cape Cod and Islands market. She and her business partner, Tjark

Aldeborgh, opened Homes on Martha’s Vineyard in 2011 at Post Office Square in

Edgartown. Homes on Martha’s

Vineyard offers a full range of real estate services – sales, rentals and

property management. A full-time,

year round business, their real estate agents are committed and caring; making

sure that their customers are treated with unequaled service and

professionalism. Susan can be

reached at 508-939-0206 or at Susan@HomesonMVY.com.

Subscribe to:

Posts (Atom)